The United States car insurance industry has undergone significant transformation in 2025, with premium costs reaching unprecedented levels and market consolidation accelerating among major providers . As consumers face rising premiums averaging $2,692 annually, understanding the competitive landscape has become crucial for both individual policyholders and fleet managers seeking optimal coverage solutions .

The premium segment of the market has particularly evolved, with specialized insurers offering enhanced services, agreed-value coverage, and concierge-level customer support to affluent clientele. This comprehensive analysis examines the leading car insurance companies in 2025, focusing on premium market offerings, technological innovations, and competitive positioning within an increasingly complex regulatory environment.

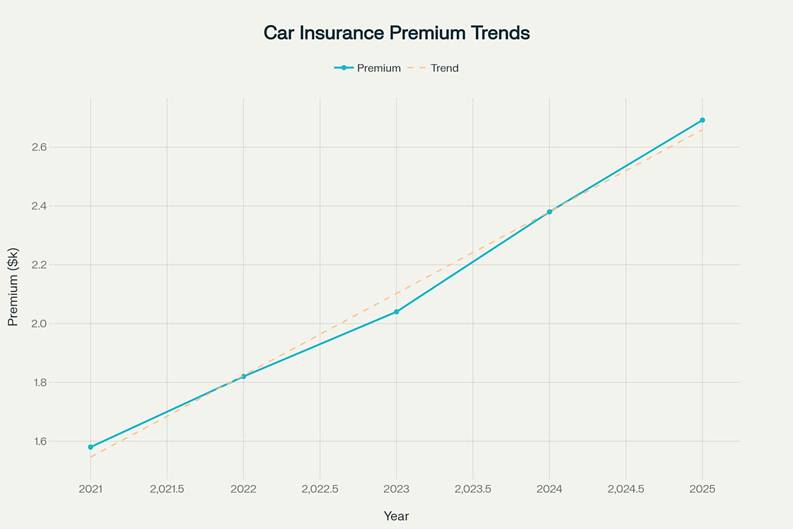

Car Insurance Premium Trends 2021-2025 – Rising Costs in the US Market

Market Landscape and Industry Dynamics

Current Market Structure and Leadership

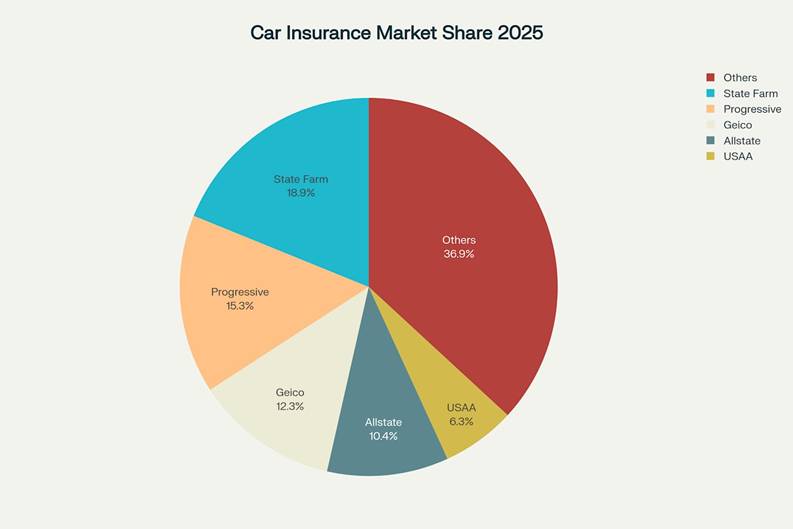

The car insurance industry in 2025 demonstrates remarkable concentration among the top five providers, which collectively control 63.59% of the market, representing an increase from 62.49% in 2023 . State Farm maintains its position as the dominant market leader with 18.87% market share and $68 billion in direct written premiums, followed by Progressive at 15.3% with $48.3 billion in premiums . The competitive landscape shows Geico securing third position with 12.3% market share, while Allstate holds 10.4% of the market . USAA, despite its restricted eligibility to military members and their families, commands 6.3% of the market with exceptional customer satisfaction ratings .

US Car Insurance Market Share 2025 – Top Companies by Premium Volume

Market dynamics reveal significant shifts in company positioning, with Liberty Mutual experiencing a notable decline from sixth to seventh place, seeing direct written premiums drop from over $13 billion in 2023 to $11.7 billion in 2024 . Nationwide fell out of the top 10 entirely, slipping from number 10 to number 13, indicating the volatile nature of market competition . These changes reflect broader industry trends toward consolidation and the challenges facing traditional insurers in adapting to evolving consumer preferences and technological demands .

Premium Inflation Trends and Cost Pressures

The car insurance industry faces unprecedented premium inflation, with average costs increasing 13.1% in 2025 following a 16.7% increase in 2024 . This represents a cumulative 70% increase from 2021 levels, significantly outpacing general inflation rates . Multiple factors contribute to this inflationary pressure, including rising repair costs driven by advanced vehicle technology, increased litigation expenses, and higher frequency of severe weather events causing vehicle damage .

Specific cost drivers include the integration of sophisticated safety systems, sensors, and cameras in modern vehicles, which require specialized repair expertise and expensive original equipment manufacturer (OEM) parts . Labor costs in automotive repair have also escalated, with skilled technicians commanding premium wages due to the technical complexity of contemporary vehicles . Additionally, the rise in litigation related to auto accident claims has significantly impacted insurer profitability, leading to broad-based premium increases across the industry .

Premium Market Segment Analysis

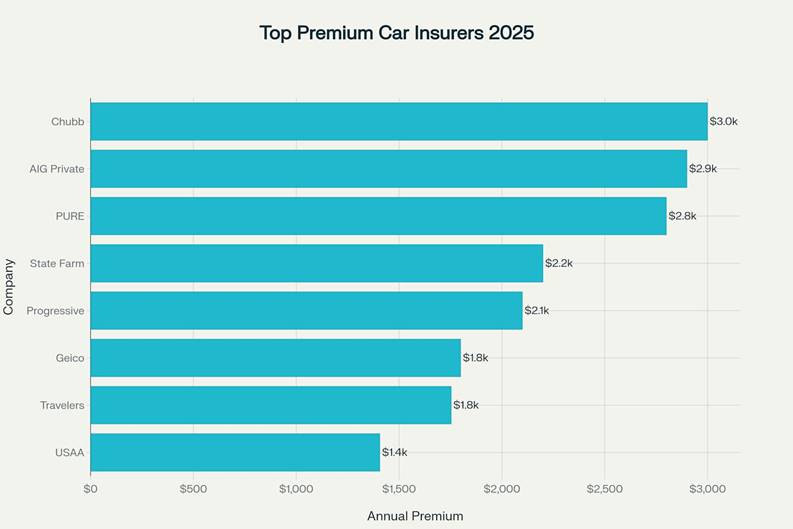

High Net Worth Insurance Providers

The premium car insurance segment caters specifically to affluent individuals with high-value vehicles, substantial assets, and unique coverage requirements that extend beyond standard policies . This market segment has experienced robust growth as wealth concentration increases and luxury vehicle ownership expands among high net worth individuals . Premium providers distinguish themselves through specialized coverage options, personalized service delivery, and comprehensive risk management solutions tailored to protect significant assets .

Premium Car Insurance Companies Comparison 2025 – Key Features and Pricing

Chubb leads the premium segment with its Masterpiece auto insurance policy, specifically designed for high-net-worth families seeking white-glove coverage and services . The company offers generous rental reimbursement coverage up to $15,000 with no per-day limits, allowing policyholders to rent vehicles comparable to their regular automobiles . Chubb’s commitment to using original equipment manufacturer parts ensures vehicles maintain their integrity and value following repairs, while worldwide rental car coverage extends protection globally .

PURE Insurance operates on a member-owned model, exclusively serving ultra-high net worth individuals with property values exceeding $1 million . The company’s selective underwriting approach focuses on financially responsible families, resulting in fewer claims and average annual savings of 20% compared to traditional insurers . PURE’s agreed value coverage ensures total loss settlements without depreciation concerns, while Member Advocates provide dedicated support throughout the claims process .

AIG Private Client Group offers comprehensive coverage for virtually unlimited vehicle types on a single policy, from everyday automobiles to collector cars, motorcycles, and recreational vehicles . The company’s Core Auto coverage option provides flexibility for clients preferring reduced premiums in exchange for streamlined coverage, while maintaining access to exceptional claims specialists . AIG’s global coverage extends protection worldwide, with liability limits reaching up to $100 million through umbrella policies .

Military and Veterans Focused Coverage

USAA maintains its position as the premier insurance provider for military members, veterans, and their families, consistently earning the highest customer satisfaction ratings in the industry . The company’s unique membership model restricts eligibility to military community members, creating a focused customer base with shared values and experiences . USAA’s full coverage policies average $1,407 annually, significantly below the national average of $2,692, while maintaining exceptional service quality.

USAA’s standout features include accident forgiveness for qualified members, ensuring premiums don’t increase following the first at-fault accident . The company’s roadside assistance program provides comprehensive support including towing, flat tire replacement, jump starts, lockout service, and fuel delivery . Claims satisfaction consistently ranks among the highest in J.D. Power surveys, with the mobile app facilitating easy digital claims filing and live support praised for compassionate and knowledgeable service .

The military-focused approach extends to specialized discounts including deployment-related benefits, vehicle storage discounts for deployed members, and family transition support for teenage drivers . USAA’s financial strength rating of A++ from multiple agencies provides additional security for long-term policy commitments . Gap coverage options protect financed vehicles, while competitive auto loan rates create comprehensive financial solutions for military families .

General Market Premium Offerings

Travelers earned recognition as the best overall car insurance company in 2025 according to NerdWallet’s analysis, offering comprehensive coverage options and extensive discount programs . The company’s full coverage costs average $1,754 annually with monthly premiums of $146, positioning it competitively within the premium segment . Travelers received fewer customer complaints than expected for auto insurance, indicating strong customer service performance .

State Farm, despite its massive market presence, maintains competitive positioning in the premium segment through superior mobile app ratings and comprehensive digital experience . The company offers specialized coverage for luxury vehicles including OEM parts coverage and enhanced service options . State Farm’s extensive agent network provides personalized service, while bundle discounts of up to 20% for multiple vehicles create value for affluent families with multiple cars .

Progressive’s Name Your Price tool helps customize high-end auto policies, while the company’s telematics programs offer usage-based insurance options for premium customers . Despite average customer satisfaction ratings, Progressive’s innovative technology platform and flexible coverage options appeal to tech-savvy premium customers . The company’s acquisition of specialty insurers has expanded its capabilities in the high-value vehicle market .

Technology Integration and Innovation

Artificial Intelligence and Automation

Artificial intelligence has become a transformative force in the car insurance industry, revolutionizing underwriting, claims processing, and customer service delivery . AI-driven tools enable more accurate risk assessment through predictive analytics, allowing insurers to develop tailored policy recommendations based on comprehensive data analysis . Machine learning algorithms process vast amounts of telematics data, driving behavior patterns, and historical claims information to create personalized pricing models .

Claims processing has been significantly enhanced through AI implementation, with automated damage assessment reducing processing times and improving accuracy . Computer vision technology enables rapid evaluation of vehicle damage through smartphone photos, while natural language processing streamlines customer interactions and reduces manual intervention requirements . These technological advances particularly benefit premium customers who expect rapid, efficient service delivery .

Fraud detection capabilities have improved dramatically through AI implementation, with pattern recognition algorithms identifying suspicious claims patterns and reducing fraudulent payouts . This enhanced fraud prevention contributes to overall cost management, helping insurers maintain competitive pricing while protecting legitimate policyholders . Premium insurers leverage these technologies to provide superior service quality while managing operational costs effectively .

Telematics and Usage-Based Insurance

Telematics technology has gained significant traction in 2025, enabling usage-based insurance (UBI) programs that reward safe driving behaviors with reduced premiums . Connected vehicle systems provide real-time data on acceleration patterns, braking behavior, nighttime driving frequency, and overall mileage, creating personalized risk profiles . This data-driven approach particularly appeals to responsible drivers seeking premium coverage at competitive rates .

Tesla’s Real-Time Insurance exemplifies advanced telematics implementation, using Safety Score calculations to determine monthly premiums based on actual driving behavior . The system eliminates traditional risk factors like age and gender, focusing exclusively on controllable driving behaviors . Premium adjustments occur monthly based on Safety Score performance, creating dynamic pricing that rewards safe driving practices .

Traditional premium insurers have integrated telematics capabilities to enhance their value propositions, offering optional programs that provide discounts for safe driving while maintaining comprehensive coverage options . These programs particularly benefit families with multiple drivers, allowing individual performance tracking and customized premium adjustments . The integration of telematics with existing premium services creates enhanced value for affluent customers seeking both comprehensive coverage and cost optimization .

Digital Transformation and Customer Experience

Digital transformation has become essential for premium insurers seeking to meet evolving customer expectations for seamless, technology-enabled service delivery . Mobile applications now provide comprehensive policy management capabilities, including claims filing, document access, roadside assistance coordination, and real-time customer support . Premium customers particularly value these digital tools for their convenience and efficiency .

Digital insurance wallets represent an emerging trend, centralizing multiple policies and enabling streamlined management across different coverage types . These platforms enhance customer retention by creating stronger relationships and providing convenient access to all insurance information . Premium insurers are developing sophisticated digital platforms that integrate with existing concierge services to provide hybrid digital-personal service models .

Automation has streamlined policy verification and reduced administrative overhead, enabling insurers to focus resources on high-value customer service activities . This operational efficiency particularly benefits premium customers who expect both technological sophistication and personalized attention . The combination of automation and human expertise creates optimal service delivery models for high-net-worth clients .

Coverage Features and Benefits Analysis

Agreed Value Coverage and Asset Protection

Agreed value coverage represents a fundamental distinction between premium and standard car insurance policies, providing predetermined settlement amounts for total loss claims without depreciation deductions . This feature particularly benefits owners of luxury, collector, or limited-production vehicles that may appreciate or maintain value over time . Premium insurers work with policyholders to establish appropriate agreed values based on market analysis and vehicle condition assessments .

Chubb’s agreed value coverage extends to both collision and comprehensive insurance, ensuring policyholders receive full compensation regardless of market fluctuations at the time of loss . This protection proves especially valuable for exotic vehicles, vintage automobiles, and limited-edition models where replacement costs may exceed original purchase prices . The agreed value approach eliminates disputes over vehicle valuations during claims processing .

PURE Insurance’s agreed value coverage includes total loss settlements without deductibles, providing maximum financial protection for high-value vehicles . The company’s lease gap coverage addresses outstanding loan balances that may exceed agreed value settlements, ensuring policyholders avoid out-of-pocket expenses . This comprehensive approach protects both vehicle equity and financing obligations .

Original Equipment Manufacturer Parts Coverage

Original Equipment Manufacturer (OEM) parts coverage ensures vehicle repairs maintain factory specifications and preserve vehicle integrity, particularly important for luxury and high-performance automobiles . Premium insurers recognize that affluent customers expect their vehicles to be restored to original condition following accidents, rather than accepting aftermarket alternatives . This coverage often extends to replacement glass, sensors, and electronic components that are integral to modern vehicle safety systems .

Chubb guarantees the use of OEM parts for all covered repairs, regardless of part wear and tear at the time of the accident . This commitment ensures vehicles maintain their safety ratings, warranty coverage, and resale value following repairs . The company’s certified repair network specializes in luxury vehicle restoration and provides lifetime guarantees on completed work .

PURE Insurance includes OEM parts coverage as a standard feature, with Member Advocates assisting in locating appropriate repair facilities specializing in high-end vehicles . The company’s auto repair network maintains relationships with certified technicians trained in luxury vehicle repair techniques . Original Equipment Equivalent (OEE) parts are used for glass replacement when OEM options are unavailable .

Concierge Services and Premium Support

Concierge services distinguish premium car insurance providers through personalized assistance that extends beyond traditional claims processing . These services include rental vehicle delivery, repair facility coordination, travel arrangement assistance, and comprehensive support during extended claims processes . Premium customers value these services for their time-saving benefits and stress reduction during challenging situations .

PURE Insurance’s Member Advocate program assigns dedicated specialists to support policyholders throughout their insurance experience . These advocates coordinate repair arrangements, rental vehicle delivery, and travel accommodations when vehicles become inoperable far from home . The program includes assistance with documentation, logistics coordination, and ensuring optimal claim outcomes .

Chubb’s concierge services include identity management support, providing fraud specialists to guide customers through identity theft resolution processes . The company offers comprehensive assistance with police report filing, documentation preparation, and credit monitoring services . Personal information removal services ensure vehicle data systems are properly cleared following total loss situations .

AIG Private Client Group provides extensive concierge support including worldwide coverage coordination, emergency assistance, and comprehensive claims advocacy . The company’s claims specialists understand the unique requirements of high-net-worth clients and provide tailored solutions for complex situations . Services extend to pet injury coverage, personal property protection, and emergency living expense assistance .

Financial Strength and Stability Assessment

Credit Rating Analysis and Insurer Security

Financial strength ratings provide crucial indicators of insurance companies’ long-term stability and claims-paying ability, particularly important for premium customers making substantial coverage investments . A.M. Best, Standard & Poor’s, Moody’s, and Fitch provide comprehensive evaluations based on operating performance, asset quality, financial flexibility, and capitalization . Premium insurers generally maintain superior ratings reflecting their conservative underwriting practices and affluent customer bases .

Chubb maintains an A++ rating from A.M. Best, representing the highest financial strength category and indicating superior ability to meet ongoing insurance obligations . The company’s consistent financial performance and conservative investment strategy provide security for long-term policy commitments . Chubb’s global diversification and robust capital structure support its premium pricing and comprehensive coverage offerings .

USAA holds A++ ratings from multiple agencies, reflecting its mutual ownership structure and conservative financial management . The military membership model creates a stable customer base with lower claim frequencies and stronger financial discipline . USAA’s financial strength supports its ability to maintain competitive pricing while providing exceptional service quality .

State Farm, Travelers, and Geico all maintain A++ ratings, demonstrating the financial stability of major market participants . These ratings support their ability to compete effectively in both standard and premium market segments . The financial strength of these large insurers provides confidence for customers seeking long-term coverage relationships .

Market Performance and Competitive Position

Premium insurers have demonstrated resilient financial performance despite industry-wide challenges including rising claim costs, increased litigation, and severe weather impacts . The selective underwriting practices and affluent customer bases of premium providers create more stable risk profiles compared to standard market participants . This stability enables premium insurers to maintain comprehensive coverage offerings while managing financial risks effectively .

PURE Insurance’s member-owned model generates average annual savings of 20% compared to traditional insurers while maintaining superior coverage quality . The company’s careful member selection and proactive risk management create favorable loss ratios and sustainable pricing . PURE’s expansion into Canada demonstrates confidence in its business model and growth potential .

Chubb’s focus on high-net-worth customers creates premium pricing power and reduces exposure to price-sensitive market segments . The company’s comprehensive service offerings and strong brand recognition support customer retention and profitable growth . Chubb’s global presence and diversified product portfolio provide stability during challenging market conditions .

Market consolidation trends favor well-capitalized insurers with strong technological capabilities and comprehensive service offerings . Premium insurers’ focus on affluent customers and comprehensive coverage creates defensive positioning against competitive pressures . The increasing complexity of modern vehicles and growing wealth concentration support continued growth in the premium insurance segment .

Customer Satisfaction and Service Quality

Comparative Satisfaction Metrics

Customer satisfaction measurements reveal significant variations among car insurance providers, with premium-focused companies generally achieving superior ratings through personalized service and comprehensive coverage offerings . J.D. Power studies consistently rank USAA at the top of customer satisfaction surveys, reflecting the company’s commitment to military community members and exceptional service delivery . The company’s 8.9 out of 10 rating in The Zebra’s Customer Satisfaction Survey demonstrates consistently high performance across multiple evaluation criteria .

Erie Insurance achieved second place with an 8.5 out of 10 rating, demonstrating that regional carriers can compete effectively through superior customer service and competitive pricing . American Family Insurance earned third place with an 8.4 out of 10 rating, highlighting the importance of personalized agent support and unique coverage options . These results indicate that customer satisfaction depends more on service quality and coverage comprehensiveness than company size or market share .

Chubb’s focus on high-net-worth customers generates excellent satisfaction ratings through specialized coverage options and premium service delivery . The company received fewer complaints than expected relative to its size, according to National Association of Insurance Commissioners data . Chubb’s white-glove approach to claims handling and comprehensive coverage options create superior customer experiences .

PURE Insurance maintains excellent customer satisfaction through its Member Advocate program and selective customer base . The company’s member-owned model aligns interests between the insurer and policyholders, creating superior service incentives . However, PURE’s limited digital tools compared to larger insurers may impact some customer preferences .

Claims Processing Excellence

Claims processing efficiency has become a key differentiator among premium insurers, with technology integration enabling faster, more accurate claim resolution . USAA’s mobile app facilitates easy digital claims filing while maintaining access to knowledgeable customer service representatives . The company’s claims satisfaction consistently ranks among the highest in industry surveys, reflecting comprehensive training and customer-focused processes .

Chubb’s certified repair shop network provides lifetime guarantees on completed work, demonstrating confidence in repair quality and customer commitment . The company’s worldwide coverage ensures consistent claims support regardless of incident location . Chubb’s removal of personal information from totaled vehicles addresses modern privacy concerns and provides additional value .

PURE Insurance’s Member Advocates coordinate all aspects of the claims process, from initial reporting through final settlement . The company’s agreed value coverage eliminates valuation disputes and accelerates claim resolution . PURE’s worldwide rental coverage and transportation expense benefits provide comprehensive support during extended repair periods .

Premium insurers’ investment in specialized claims personnel and advanced technology creates superior customer experiences compared to standard market providers . The combination of personalized service and efficient processing particularly appeals to affluent customers who value both quality and convenience . These service advantages justify premium pricing and support customer retention .

Electric Vehicle and Specialty Coverage

Electric Vehicle Insurance Considerations

Electric vehicle insurance presents unique challenges and opportunities in 2025, with specialized coverage requirements reflecting the distinct characteristics of electric powertrains and advanced technology systems . Tesla vehicles experience insurance premium increases at twice the market rate, with Model Y premiums rising 29% in 2025 compared to the 10% industry average . This acceleration reflects higher repair costs, specialized part requirements, and limited service network availability .

Tesla’s Model 3 insurance costs average $4,364 annually, while Model X coverage reaches $4,046 annually, significantly exceeding traditional vehicle insurance costs . The complexity of electric vehicle systems, including battery technology, regenerative braking systems, and advanced driver assistance features, requires specialized repair expertise and expensive replacement components . These factors create higher claim costs and increased insurance premiums .

Premium insurers have developed specialized electric vehicle coverage addressing unique risks including battery replacement, charging system damage, and cyber security vulnerabilities . Advanced electric vehicles often include sophisticated software systems and connectivity features that create additional coverage requirements . Premium providers recognize that affluent early adopters of electric vehicles require comprehensive protection for their significant investments .

Insurance for electric vehicles manufactured by legacy automakers like Ford and Volkswagen costs 25% less than coverage for vehicles from EV-only manufacturers . This pricing differential reflects established service networks, parts availability, and repair expertise among traditional automotive dealerships . Premium insurers consider these factors when developing specialized electric vehicle coverage programs .

Luxury and Exotic Vehicle Coverage

Luxury and exotic vehicle insurance requires specialized underwriting and coverage approaches that recognize the unique characteristics and values of high-end automobiles . Many broad market insurers refuse to cover exotic vehicles like Ferraris, Lamborghinis, and McLarens, creating opportunities for premium insurers with specialized expertise . High-value auto policies typically feature agreed-value coverage, higher liability limits, and enhanced service options .

Geico offers luxury vehicle coverage starting at $165 monthly with 25% bundling discounts for customers combining multiple coverage types . State Farm provides superior OEM parts coverage ensuring luxury vehicles maintain their integrity following repairs . Progressive’s Name Your Price tool enables customization of high-end auto policies to match specific coverage requirements and budget preferences .

Premium insurers like Chubb, PURE, and AIG Private Client Group specialize in exotic vehicle coverage with comprehensive protection and white-glove service . These companies understand the unique requirements of collector vehicles, limited-production automobiles, and custom-built exotic cars . Specialized coverage includes worldwide protection, unlimited rental reimbursement, and access to certified repair facilities .

The luxury vehicle market continues expanding as wealth concentration increases and exotic vehicle production grows . Premium insurers’ expertise in this segment creates competitive advantages and justifies higher pricing through superior coverage and service . The combination of agreed-value coverage, OEM parts protection, and concierge services provides comprehensive protection for significant automotive investments .

Regional Market Variations and Regulatory Environment

State-by-State Premium Variations

Car insurance premiums vary dramatically across states due to regulatory differences, weather patterns, population density, and local economic conditions . Florida leads the nation with average full coverage costs of $4,125 annually, followed by Nevada at $3,216 and Michigan at $3,156 . These high-cost states reflect challenging driving conditions, severe weather exposure, and elevated litigation risks .

Idaho offers the lowest average premiums at $1,481 annually for full coverage, demonstrating the impact of rural driving conditions and lower population density . States with lower premiums generally feature fewer urban areas, reduced traffic congestion, and less severe weather patterns . Premium insurers must adjust their pricing and coverage offerings to reflect these regional variations .

New Jersey, Washington, and California expect premium increases exceeding 15% in 2025, representing the largest jumps nationwide . These increases reflect regulatory changes, increased litigation costs, and rising repair expenses in high-cost metropolitan areas . Premium insurers operating in these markets must balance competitive pricing with adequate coverage for affluent customers .

Regulatory frameworks significantly impact premium insurers’ ability to offer specialized coverage and pricing flexibility . States with more restrictive insurance regulations may limit premium insurers’ ability to provide customized coverage options and risk-based pricing . Understanding regulatory environments becomes crucial for premium insurers seeking to expand their geographic footprints .

Regulatory Compliance and Innovation

Insurance regulation continues evolving to address technological innovation, data privacy concerns, and climate risk management requirements . Stricter data privacy laws demand robust measures to protect sensitive customer information, particularly relevant for premium insurers handling high-net-worth client data . Blockchain technology and advanced encryption methods help premium insurers meet these enhanced security requirements .

Climate risk management regulations increasingly require insurers to assess and disclose climate-related risks, influencing product design and investment strategies . Premium insurers must consider how extreme weather events impact luxury vehicles and high-value properties . This regulatory focus creates opportunities for premium insurers to differentiate through superior risk management and coverage options .

Cross-border regulations challenge insurers operating internationally, requiring navigation of complex compliance requirements . Premium insurers serving affluent clients with global lifestyles must ensure worldwide coverage meets local regulatory standards . PURE Insurance’s expansion into Canada demonstrates the complexity of international regulatory compliance .

Telematics regulation and usage-based insurance oversight continue evolving as these technologies become mainstream . Premium insurers implementing telematics programs must balance data collection benefits with privacy protection requirements . Regulatory clarity supports continued innovation while protecting consumer interests .

Technology Trends and Future Innovations

Autonomous Vehicle Preparation

The gradual introduction of autonomous vehicle technology creates significant implications for car insurance coverage and pricing models . Premium insurers must prepare for fundamental shifts in liability allocation as vehicles assume greater control over driving decisions . The transition period will likely feature hybrid coverage models addressing both human driver and vehicle system responsibilities .

Advanced driver assistance systems (ADAS) already present complex coverage considerations for premium insurers . These systems require specialized repair expertise and expensive calibration procedures following accidents . Premium insurers’ relationships with certified repair facilities become increasingly important as vehicle technology advances .

Liability coverage may shift toward manufacturers and software providers as autonomous systems assume greater driving responsibilities . Premium insurers must develop new coverage models addressing product liability, cyber security vulnerabilities, and software failure risks . These changes create opportunities for innovative coverage approaches and service differentiation .

The premium customer segment will likely lead autonomous vehicle adoption due to early access to advanced technology and higher vehicle values . Premium insurers must develop specialized coverage addressing the unique risks and requirements of early autonomous vehicle adopters . This expertise will provide competitive advantages as autonomous technology becomes mainstream .

Artificial Intelligence Enhancement

Artificial intelligence capabilities continue expanding across all aspects of insurance operations, from underwriting and pricing to claims processing and customer service . Machine learning algorithms enable more sophisticated risk assessment incorporating vast amounts of behavioral, environmental, and vehicle data . Premium insurers leverage these capabilities to provide more accurate pricing and personalized coverage options .

Predictive analytics help premium insurers identify emerging risks and develop proactive coverage solutions . AI-powered fraud detection reduces claim costs and protects honest policyholders from increased premiums . These technological advances particularly benefit premium customers who value both innovation and financial protection .

Natural language processing enhances customer service capabilities, enabling more efficient communication and faster problem resolution . Premium insurers use AI to provide 24/7 customer support while maintaining access to human specialists for complex situations . This hybrid approach delivers efficiency benefits while preserving the personalized service premium customers expect .

Computer vision technology revolutionizes damage assessment and claims processing, enabling rapid evaluation through smartphone photos and reducing processing times . Premium insurers’ investment in these technologies creates competitive advantages through superior service delivery and operational efficiency . The combination of technology and human expertise optimizes the premium customer experience .

Conclusion and Future Outlook

The car insurance industry in 2025 reflects a dynamic marketplace characterized by technological innovation, premium inflation, and evolving customer expectations . Premium insurers have successfully differentiated themselves through specialized coverage options, superior service delivery, and comprehensive protection for high-value assets . The market’s continued consolidation favors well-capitalized insurers with strong technological capabilities and comprehensive service offerings .

Premium customers increasingly demand sophisticated coverage solutions that address the complexities of modern vehicles, global lifestyles, and substantial asset protection requirements . The success of companies like Chubb, PURE Insurance, and AIG Private Client Group demonstrates the viability of specialized premium market strategies . These insurers’ focus on agreed-value coverage, concierge services, and comprehensive protection creates sustainable competitive advantages .

Technological innovation will continue reshaping the insurance landscape, with artificial intelligence, telematics, and autonomous vehicle preparation driving industry evolution . Premium insurers’ investment in these technologies while maintaining personalized service creates optimal value propositions for affluent customers . The integration of advanced technology with human expertise defines the premium insurance experience .

The electric vehicle transition and increasing vehicle complexity create both challenges and opportunities for premium insurers . Companies with specialized expertise in high-value vehicle coverage and advanced technology integration are well-positioned for continued growth . The premium market’s expansion reflects broader wealth trends and increasing demand for sophisticated insurance solutions .

Market participants must navigate regulatory evolution, climate risk management requirements, and changing liability frameworks as vehicle technology advances . Premium insurers’ expertise in complex coverage solutions and regulatory compliance provides competitive positioning . The combination of financial strength, technological innovation, and superior service delivery will determine long-term success in the evolving premium car insurance market .