Finding affordable auto insurance as a young driver in 2025 has become increasingly challenging, with average premiums for drivers aged 16-24 reaching $5,340 annually. Young drivers face the highest insurance rates due to statistical data showing higher accident frequencies and inexperience behind the wheel. However, multiple strategies and premium insurance options can significantly reduce these costs while maintaining comprehensive coverage.

A young driver learning to drive with her parent.

The insurance landscape has evolved dramatically in 2025, with technology-driven solutions and specialized premium segment offerings creating new opportunities for cost savings. Young drivers who understand the market dynamics and leverage available discounts can achieve substantial premium reductions while accessing high-quality coverage.

Understanding Young Driver Insurance Costs in 2025

Current Market Pricing and Trends

Young driver insurance costs vary significantly based on age, with 16-year-old drivers paying an average of $628 monthly for males and $563 for females. These rates decrease progressively with age, dropping to $364 for 19-year-old males and $324 for 19-year-old females. The premium segment has responded to these challenges by offering specialized coverage options that balance affordability with comprehensive protection.

The cost differential between adding a teen to a parent’s policy versus purchasing separate coverage is substantial. Adding a teenager to an existing family policy averages $299 monthly, while independent teen policies cost approximately $468 monthly. This pricing structure reflects insurance companies’ risk assessment models and the benefits of multi-driver policies.

State-by-State Variations

Geographic location dramatically impacts young driver insurance costs, with Louisiana leading as the most expensive state at $8,412 annually for teen drivers. Delaware and Nevada follow with similarly high premiums, while Hawaii offers the most affordable rates at just $1,639 annually. These variations reflect local accident rates, weather patterns, and regulatory environments.

Premium insurers have adapted their pricing models to account for these regional differences. States like Iowa ($1,612 annually), Alabama ($2,273), and North Carolina ($2,312) offer significantly lower rates for young drivers. Understanding these geographic factors helps families make informed decisions about coverage options and potential relocation considerations.

Top Insurance Companies for Young Drivers

Most Affordable National Providers

GEICO consistently ranks as the cheapest option for young drivers, offering full coverage at $301 monthly for 20-year-olds. The company’s digital-first approach and efficient claims processing contribute to its competitive pricing structure. GEICO’s commitment to technology integration appeals to tech-savvy young drivers while maintaining affordable premiums.

USAA provides exceptional value for military families, with rates averaging $270 monthly for young drivers. Despite restricted eligibility, USAA’s customer satisfaction ratings and comprehensive coverage options make it the premium choice for qualifying families. The company’s financial strength and specialized understanding of military lifestyle needs create significant value.

State Farm offers competitive rates at $333 monthly for families with teen drivers. The company’s extensive agent network provides personalized service that many families value during the challenging teen driver years. State Farm’s Steer Clear program offers additional savings for young drivers completing approved driving courses.

Regional and Specialty Providers

Erie Insurance leads regional providers with rates as low as $119 monthly for minimum coverage. The company’s focus on customer service and competitive pricing makes it an attractive option in its service territories. Erie’s YourTurn program rewards safe driving with cash incentives, appealing to young drivers seeking immediate benefits.

Auto-Owners provides affordable coverage starting at $42 monthly for liability-only policies. The company’s regional focus allows for personalized underwriting and competitive rates in specific markets. Auto-Owners’ commitment to local service and community involvement resonates with families seeking personalized attention.

Country Financial offers some of the lowest rates at $20 monthly for basic coverage. The company’s agricultural heritage and focus on rural markets creates unique advantages for young drivers in specific geographic areas. Country Financial’s emphasis on community relationships and long-term customer partnerships appeals to families seeking stable insurance relationships.

Premium Segment Specialized Offerings

Chubb’s Masterpiece auto insurance extends its premium service model to younger drivers in high-net-worth families. The company’s agreed-value coverage and white-glove service provide comprehensive protection for luxury vehicles driven by young family members. Chubb’s worldwide coverage and OEM parts guarantee ensure vehicles maintain their integrity regardless of driver age.

PURE Insurance’s member-owned model offers unique advantages for affluent families with young drivers. The company’s selective underwriting and Member Advocate program provide personalized support during the challenging early driving years. PURE’s focus on financially responsible families creates lower claims frequencies and competitive pricing.

A young driver shows off her new car keys.

Essential Discounts and Savings Strategies

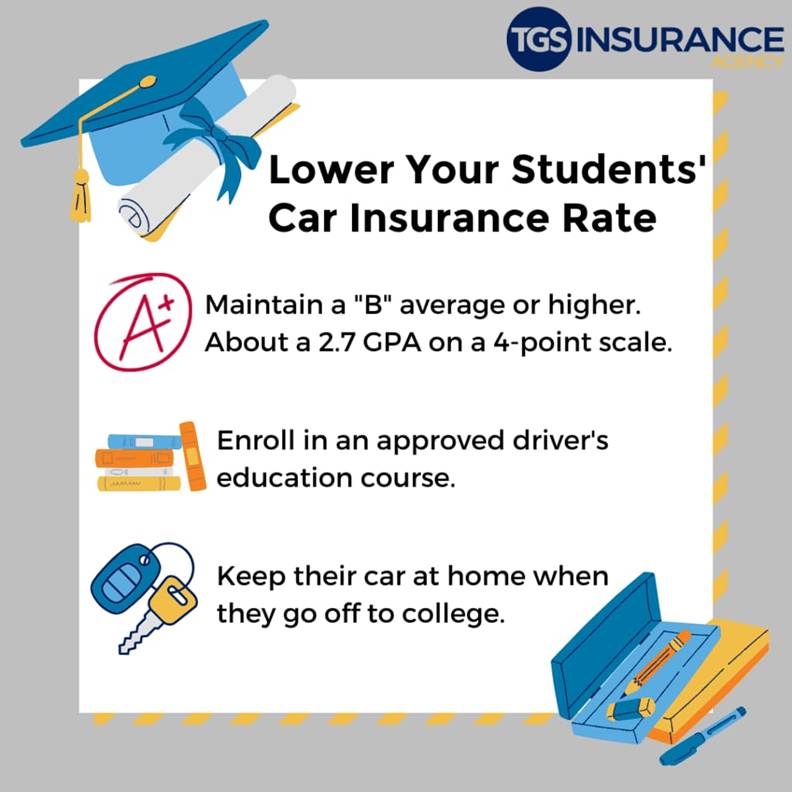

Academic Achievement Discounts

Good student discounts represent one of the most significant savings opportunities for young drivers. Most major insurers offer discounts ranging from 5% to 25% for students maintaining B averages or higher. Progressive’s good student discount starts at 5% and can provide substantial annual savings. These discounts typically require verification through report cards or transcripts.

Student-away-from-school discounts benefit college students who don’t have regular access to vehicles. Progressive offers distant student discounts for students attending schools 100+ miles from home. This discount recognizes reduced driving exposure and lower risk profiles for students without campus vehicle access.

Ways students can lower their car insurance rate.

Driver Education and Training Benefits

Completing approved driver education courses can generate significant insurance discounts. State Farm’s Steer Clear program provides app-based training for drivers under 25, resulting in substantial premium reductions upon completion. These programs combine theoretical knowledge with practical driving skills, appealing to both insurers and families.

Defensive driving courses offer ongoing savings opportunities beyond initial licensing. Amica Insurance partners to provide discounted online courses that directly translate to insurance savings. These courses focus on accident prevention and risk management, aligning with insurers’ goals of reducing claims frequency.

Multi-Policy and Family Discounts

Bundling policies creates significant savings opportunities for families with young drivers. Combining auto insurance with homeowners or renters insurance can generate discounts up to 25%. These bundling strategies particularly benefit families in the premium segment, where multiple high-value policies create substantial discount opportunities.

Multi-car discounts reward families insuring multiple vehicles with the same company. Adding a young driver to a multi-car policy often costs less than anticipated due to these volume discounts. Premium insurers recognize the value of multi-generational relationships and offer enhanced discounts for comprehensive family coverage.

Technology-Based Insurance Solutions

Usage-Based Insurance Programs

Telematics technology has revolutionized young driver insurance by enabling behavior-based pricing. These programs monitor driving habits including speed, acceleration, braking, and phone usage to determine individualized rates. Young drivers demonstrating safe behaviors can achieve discounts up to 40% through these programs.

A hand holding a telematics device used for car insurance.

GEICO’s DriveEasy program offers state-specific discounts based on driving performance. The program uses smartphone apps to track driving behaviors and provides ongoing feedback to encourage improvement. Participants receive initial discounts simply for enrollment, with additional savings based on performance.

Progressive’s Snapshot program has evolved to include more sophisticated monitoring capabilities. The program tracks multiple driving metrics and provides personalized coaching to help young drivers improve their skills. Long-term participation can result in substantial premium reductions for consistently safe drivers.

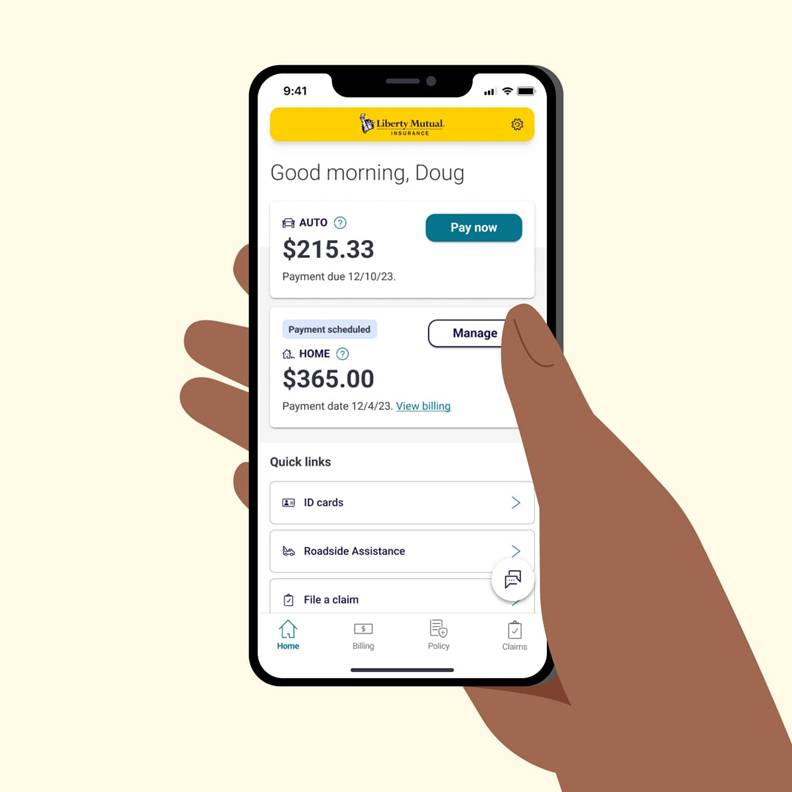

Mobile Apps and Digital Tools

Modern insurance companies offer sophisticated mobile applications that appeal to young drivers. These apps provide real-time policy management, claims filing, and roadside assistance coordination. The convenience and accessibility of mobile platforms particularly appeal to tech-native young drivers.

State Farm’s mobile app includes the Steer Clear program, combining education with practical application. The app tracks progress through driving courses and automatically applies discounts upon completion. This integration of education and insurance management creates value for both families and insurers.

Safety-focused apps like RoadReady help families track supervised driving hours required for licensing. These apps provide educational content and progress monitoring that supports both licensing requirements and insurance applications. The combination of compliance tracking and safety education appeals to families seeking comprehensive solutions.

Black Box and Telematics Devices

Physical telematics devices offer more comprehensive monitoring than smartphone-based solutions. These “black box” devices provide detailed analytics on driving patterns, vehicle location, and accident circumstances. Young drivers willing to accept monitoring can achieve significant premium reductions through demonstrated safe driving.

Black box insurance policies typically feature annual contracts with pricing adjustments based on driving performance. Careful drivers often see substantial premium reductions after the initial monitoring period. The feedback provided by these devices helps young drivers identify and correct risky behaviors.

Some premium insurers offer hybrid programs combining black box monitoring with concierge services. These programs provide comprehensive protection while maintaining the personalized service expectations of affluent families. The combination of technology and human support creates optimal value for premium segment customers.

Mobile Application promoting safer driving through trip monitoring, scoring, and data visualization.

Premium Segment Advantages and Options

Specialized Coverage Features

Premium insurers offer unique coverage options that provide superior protection for young drivers. Agreed-value coverage ensures luxury vehicles maintain their worth regardless of depreciation, particularly important for expensive cars driven by young family members. OEM parts guarantees preserve vehicle integrity and safety ratings.

Concierge services distinguish premium providers through personalized assistance during claims and emergencies. These services include rental vehicle delivery, repair facility coordination, and comprehensive support throughout the claims process. Young drivers and their families benefit from reduced stress and superior outcomes during challenging situations.

Worldwide coverage extends protection beyond domestic boundaries, important for families with international travel or students studying abroad. Premium insurers understand the global lifestyles of affluent families and provide seamless coverage regardless of location. This comprehensive approach eliminates coverage gaps that could prove costly.

Financial Strength and Stability

Premium insurers typically maintain superior financial strength ratings, providing security for long-term policy relationships. A.M. Best ratings of A++ indicate exceptional claims-paying ability and financial stability. These ratings become particularly important for families making substantial coverage investments.

The conservative underwriting practices of premium insurers create stable pricing and predictable coverage. This stability benefits families planning long-term insurance relationships during their children’s early driving years. Premium providers’ focus on financially responsible customers creates favorable risk pools and competitive pricing.

State-Specific Strategies and Regulations

Highest Cost States and Solutions

Louisiana, Florida, and Michigan represent the most expensive states for young driver insurance. Families in these states benefit from aggressive comparison shopping and maximum utilization of available discounts. Premium insurers often provide better value in high-cost states through superior coverage and service.

Nevada and California follow closely in young driver insurance costs. These states’ combination of urban driving conditions, high vehicle values, and active litigation environments creates challenging insurance markets. Families benefit from working with experienced agents who understand local market dynamics.

Most Affordable States and Opportunities

Hawaii offers unique advantages with its age-neutral insurance regulations and low accident rates. The state’s geographic isolation and limited driving environments create favorable conditions for young drivers. Families relocating to Hawaii often experience dramatic insurance savings.

Iowa, Alabama, and North Carolina provide consistently affordable young driver insurance. These states’ combination of rural driving environments, conservative litigation climates, and competitive insurance markets benefit young drivers. Families in these states should focus on maximizing available discounts rather than changing carriers.

Expert YouTube Resources for Young Drivers

Educational Video Content

. The content covers essential discount opportunities, comparison shopping techniques, and money-saving tips specifically designed for new drivers. The video emphasizes the importance of shopping around and understanding available discount programs.

. The video includes company comparisons, discount opportunities, and specific strategies for reducing premiums. This resource provides valuable insights into carrier selection and optimization strategies.

Implementation Strategy and Action Steps

Immediate Cost Reduction Steps

Young drivers should begin by gathering quotes from multiple carriers, focusing on companies known for competitive young driver rates. GEICO, USAA (if eligible), and State Farm typically provide the most affordable options for most situations. Comparison shopping can reveal differences of hundreds or thousands of dollars annually.

Academic transcripts and driver education certificates should be readily available when requesting quotes. These documents enable immediate application of good student and training discounts. Families should also prepare information about vehicle safety features and annual mileage estimates.

Long-Term Optimization Strategies

Building a strong driving record remains the most effective long-term strategy for reducing insurance costs. Young drivers who maintain clean records see substantial rate reductions at ages 21 and 25. The premium segment particularly rewards long-term customers with excellent driving histories.

Consideration of telematics programs can provide immediate and ongoing savings for safe drivers. While these programs require accepting monitoring, the potential savings justify participation for most young drivers. Premium insurers increasingly offer sophisticated programs combining monitoring with personalized coaching.

Regular policy reviews ensure ongoing optimization as circumstances change. Young drivers should reassess their coverage annually, particularly when moving, changing schools, or reaching milestone ages. Premium segment customers benefit from working with dedicated agents who proactively identify optimization opportunities.

A Liberty Mutual Insurance app showing payment details and quick links.

Conclusion and Future Outlook

The young driver insurance market in 2025 offers more opportunities than ever for cost reduction through technology, education, and strategic planning. Premium segment providers have evolved their offerings to balance comprehensive protection with competitive pricing for affluent families. The combination of traditional discounts with modern telematics programs creates multiple pathways to substantial savings.

Success in the young driver insurance market requires understanding available options, leveraging technology solutions, and maintaining focus on long-term relationship building. Families who invest time in research and optimization can achieve significant savings while ensuring comprehensive protection. The premium segment particularly rewards customers who demonstrate commitment to safety and responsible driving.

Young drivers entering the market in 2025 benefit from increased competition, technological innovation, and expanded discount opportunities. Those who approach insurance shopping strategically and maintain excellent driving records can achieve affordable coverage while building foundations for lifelong insurance relationships. The evolving landscape continues creating new opportunities for cost reduction and enhanced coverage.