The landscape of executive health insurance has undergone a dramatic transformation in 2025, with America’s wealthiest individuals increasingly investing in premium healthcare solutions that go far beyond traditional insurance coverage . These elite health plans represent a fundamental shift from reactive medical care to proactive, personalized health management systems designed specifically for high-net-worth individuals who demand the highest level of medical attention and convenience.

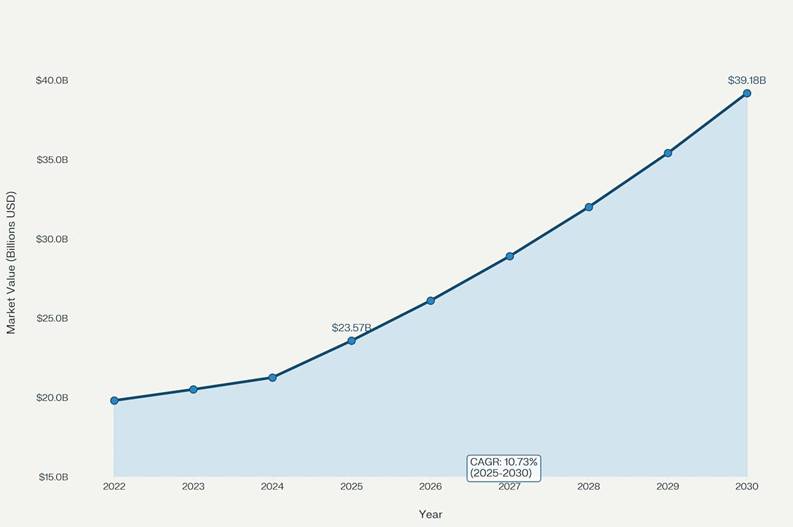

The concierge medicine market has experienced explosive growth, reaching $23.57 billion in 2025 and projected to nearly double to $39.18 billion by 2030 . This remarkable expansion reflects the growing demand among America’s top 1% for healthcare services that match their lifestyle expectations and business demands.

Executive health costs 2025

The Evolution of Executive Health Coverage

From Basic Insurance to Comprehensive Health Management

Traditional health insurance models have proven inadequate for America’s business elite, who require immediate access to top-tier medical professionals and cutting-edge treatments . The modern executive health insurance landscape has evolved to encompass comprehensive health management systems that function more like “family offices for health” rather than conventional insurance products .

These sophisticated health plans integrate multiple components including concierge medicine, executive physicals, wellness coaching, and global medical coverage . The wealthiest Americans are moving beyond simple coverage for medical emergencies to investing in preventive care systems designed to optimize their health and longevity .

Market Dynamics Driving Premium Health Services

The demand for executive health insurance has been fueled by several key factors specific to high-net-worth individuals . Business leaders face unique health challenges including chronic stress, irregular schedules, frequent travel, and limited time for traditional healthcare appointments . These factors have created a market opportunity for specialized health services that accommodate the demanding lifestyles of America’s economic elite.

Insurance industry projections for 2025 indicate continued growth in premium health services, with employers expecting healthcare costs to rise 9.2% before plan modifications . For executives and their companies, investing in comprehensive health coverage has become a strategic business decision rather than merely an employee benefit .

Premium Executive Health Insurance Components

Concierge Medicine Memberships

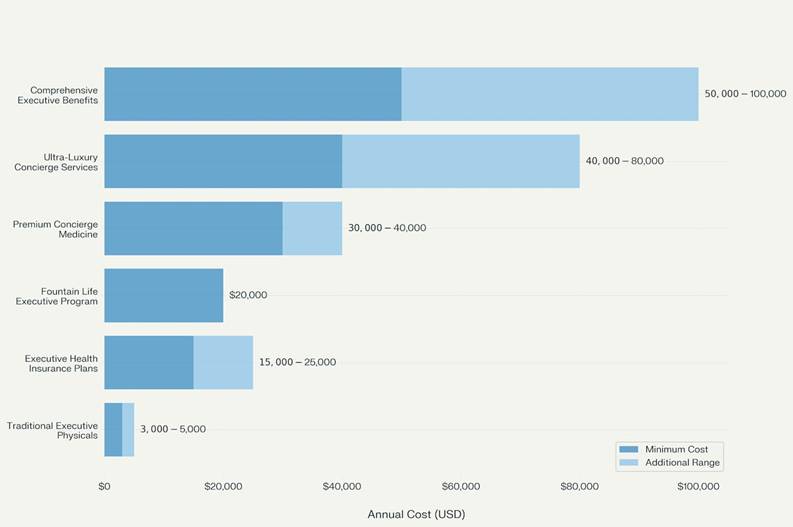

The cornerstone of executive health insurance in 2025 is concierge medicine, which provides 24/7 access to personal physicians and immediate medical attention . Premium concierge services like Private Medical charge between $30,000 to $40,000 annually per individual, offering comprehensive health management that includes everything from routine care to emergency medical coordination .

These services extend far beyond traditional doctor visits, encompassing worldwide medical evacuation, specialist appointment coordination, and personalized health monitoring . Members receive dedicated physician time without the rushed atmosphere of conventional medical practices, allowing for thorough health assessments and detailed treatment planning .

Executive Physical Programs

Executive physicals have become a standard component of premium health packages, with leading medical institutions offering comprehensive health assessments designed specifically for busy executives . Mayo Clinic’s Executive Health Program, costing approximately $5,000 per visit, provides customized one- to three-day health evaluations that include advanced diagnostic testing and specialist consultations .

Cleveland Clinic and Johns Hopkins offer similar programs, with costs ranging from $3,000 to $5,000 depending on the comprehensiveness of testing and individual health needs . These programs focus on preventive care and early disease detection, recognizing that executive time constraints often prevent regular health monitoring .

Advanced Diagnostic and Wellness Services

The most exclusive executive health programs now incorporate cutting-edge diagnostic technologies and wellness services that were previously unavailable through traditional insurance . Fountain Life, for example, offers a $20,000 annual program featuring AI-driven disease detection, whole-body MRI scans, and genetic testing designed to identify health risks before symptoms appear .

These advanced services include hormone optimization, cardiovascular screenings, metabolic health evaluations, and personalized longevity strategies . The integration of artificial intelligence and advanced imaging technologies allows for more precise health assessments and earlier intervention in potential health issues .

Concierge medicine market growth

The Ultra-Luxury Tier: $40,000-$80,000 Annual Plans

Comprehensive Health Concierge Services

At the highest tier of executive health insurance, ultra-luxury services charge between $40,000 and $80,000 annually per family, providing what essentially amounts to a personal health management team . These services include house calls, office visits, airport consultations, and immediate access to the country’s top specialists and hospitals .

Companies like Private Medical have pioneered this model, employing teams of 135 physicians and serving over 1,000 wealthy families across multiple locations . The service model resembles financial wealth management, with dedicated health coordinators managing every aspect of a family’s medical care from routine check-ups to complex surgical procedures .

Global Health Coverage and Emergency Services

Ultra-premium health plans provide global coverage that ensures high-quality medical care regardless of location . This includes access to elite hospitals worldwide, medical evacuation services, and coordination with international specialists . For executives who travel extensively or maintain residences in multiple countries, this global coverage represents essential protection for their health investments.

Emergency services under these plans include rapid response teams, direct hospital admissions, and coordination with top medical specialists . Members can be assured of receiving immediate attention from leading physicians rather than standard emergency room care, reflecting the premium nature of these services .

Personalized Wellness and Longevity Programs

The most expensive executive health plans emphasize longevity and performance optimization rather than simply treating illness . These programs include custom fitness and nutrition coaching, mental health optimization, anti-aging treatments, and performance enhancement protocols .

Advanced genetic testing and personalized medicine play increasingly important roles in these premium packages . By analyzing individual genetic profiles and lifestyle factors, these programs can predict health risks and customize interventions to optimize long-term health outcomes .

Corporate Executive Health Benefits

Company-Sponsored Executive Health Programs

Many corporations now provide executive health benefits as part of their leadership retention strategies . These programs recognize that protecting key executives’ health represents a significant business investment, given the high costs associated with leadership turnover and illness-related productivity losses .

Corporate executive health programs typically include annual executive physicals, concierge medicine memberships, and access to premium medical facilities . Companies may spend $50,000 to $100,000 annually per executive on comprehensive health benefits, viewing this as insurance against losing critical leadership talent .

Risk Management and Business Continuity

From a corporate perspective, executive health insurance serves as risk management for business continuity . The sudden illness or death of key executives can have dramatic impacts on company performance and valuation, making comprehensive health coverage a strategic business investment rather than simply an employee benefit .

Executive health programs also provide companies with confidence in their leadership’s ability to perform at peak levels . Regular health monitoring and preventive care help ensure that executives can maintain the demanding schedules and high-stress responsibilities that their roles require .

Technology Integration and Innovation

AI-Powered Health Monitoring

The integration of artificial intelligence into executive health insurance represents a significant advancement in 2025 . AI-powered diagnostic tools can analyze vast amounts of health data to identify patterns and predict potential health issues before they become serious problems .

These technologies enable more precise risk assessments and personalized treatment recommendations . For executives who generate substantial amounts of health data through wearable devices and regular monitoring, AI analysis can provide insights that would be impossible to detect through traditional medical evaluations .

Telemedicine and Remote Health Services

Advanced telemedicine capabilities have become standard in premium executive health plans, allowing for immediate consultations regardless of location . These services are particularly valuable for executives who travel frequently or work irregular hours, providing access to their personal physicians at any time .

Remote health monitoring through sophisticated wearable devices and home diagnostic equipment enables continuous health tracking . This technology allows health teams to monitor executives’ vital signs, sleep patterns, stress levels, and other health indicators in real-time .

Market Trends and Future Projections

Growing Demand for Preventive Care

The executive health insurance market in 2025 is characterized by a strong emphasis on preventive care and wellness optimization . Rather than waiting for health problems to develop, wealthy Americans are investing in services designed to maintain peak health and prevent disease .

This shift toward prevention is driven by research showing that early intervention and lifestyle optimization can significantly impact long-term health outcomes . For executives whose careers depend on maintaining high energy levels and cognitive function, preventive health services represent essential investments .

Personalization and Data-Driven Healthcare

Personalized healthcare has become the standard expectation among high-net-worth individuals seeking executive health services . Advanced health analytics and genetic testing enable highly customized treatment plans that address individual risk factors and health goals .

Data-driven healthcare approaches allow for more precise monitoring and intervention strategies . Executives can receive detailed insights into their health status and personalized recommendations for optimization based on comprehensive data analysis .

Integration with Wellness and Lifestyle Services

Executive health insurance increasingly integrates with broader wellness and lifestyle services . This holistic approach recognizes that health optimization extends beyond medical care to include fitness, nutrition, stress management, and lifestyle coaching .

The most comprehensive programs now offer integrated platforms that coordinate medical care, wellness coaching, fitness training, and nutritional guidance . This integrated approach appeals to executives who prefer streamlined services that address all aspects of their health and wellness needs .

Cost Analysis and Value Proposition

Investment Returns on Executive Health

While executive health insurance represents a significant financial investment, the value proposition extends beyond simple medical coverage . Studies have shown that participants in executive health programs experience 20% fewer insurance claims and 45% fewer lost workdays .

For high-earning executives, the time savings and productivity benefits of premium health services often justify the substantial costs . Immediate access to physicians, streamlined appointment scheduling, and comprehensive care coordination can save dozens of hours annually while ensuring optimal health maintenance .

Comparative Cost Analysis

Traditional health insurance, even premium plans, typically costs substantially less than executive health services but provides significantly different value propositions . While conventional insurance may cost $15,000-$25,000 annually for comprehensive coverage, executive health services range from $30,000 for basic concierge medicine to $100,000+ for comprehensive luxury health management .

The cost differential reflects the level of service, accessibility, and personalization provided by executive health plans . For America’s wealthiest individuals, the premium represents access to an entirely different tier of healthcare that aligns with their lifestyle expectations and business demands .

Challenges and Considerations

Healthcare Inequality and Access

The growth of ultra-premium executive health services has intensified discussions about healthcare inequality in America . While the wealthy gain access to unprecedented levels of medical care, the disparity between executive health services and standard healthcare continues to widen .

Even among wealthy Americans, health outcomes lag behind those of affluent Europeans, suggesting that individual spending on premium healthcare may not address broader systemic health challenges . This reality highlights the complex relationship between wealth, health access, and actual health outcomes .

Regulatory and Insurance Considerations

Executive health services operate in a complex regulatory environment where many premium services fall outside traditional insurance coverage . While basic medical services may be covered by conventional insurance, the concierge fees and premium amenities typically require out-of-pocket payment .

For corporations providing executive health benefits, tax implications and regulatory compliance add complexity to program design . Companies must navigate various regulations while structuring executive health benefits that provide maximum value to leadership teams .

The Future of Executive Health Insurance

Emerging Technologies and Services

The executive health insurance market continues to evolve with emerging technologies including advanced genetic testing, regenerative medicine, and personalized therapeutics . These cutting-edge treatments, often costing hundreds of thousands of dollars, are becoming increasingly available through ultra-premium health plans .

Longevity medicine and anti-aging treatments represent growing components of executive health services . As research advances in these areas, wealthy Americans are investing in experimental and innovative treatments designed to extend healthy lifespan and optimize cognitive and physical performance .

Market Expansion and Competition

The concierge medicine market’s projected growth to $39.18 billion by 2030 indicates continued expansion and evolution of executive health services . New entrants and increased competition are likely to drive innovation while potentially making premium services more accessible to broader segments of wealthy Americans .

As the market matures, standardization of services and pricing models may emerge, though the ultra-luxury tier will likely remain highly customized and exclusive . The integration of technology and data analytics will continue to enhance the personalization and effectiveness of executive health programs .

Conclusion

Executive health insurance in 2025 represents a fundamental reimagining of healthcare for America’s wealthiest individuals . These comprehensive health management systems go far beyond traditional insurance coverage to provide personalized, immediate, and premium medical services that align with the lifestyle expectations of high-net-worth individuals .

The market’s explosive growth reflects both the unique health challenges faced by business executives and their willingness to invest substantially in maintaining optimal health . As technology continues to advance and new medical innovations emerge, executive health insurance will likely become even more sophisticated and personalized .

For America’s top 1%, executive health insurance has evolved from a luxury service to an essential business tool that enables peak performance and longevity . The substantial investments in these programs reflect a recognition that health represents the ultimate asset that requires professional management and protection .

The future of executive health insurance promises continued innovation, increased personalization, and integration of cutting-edge medical technologies . As the market matures, these services will likely set new standards for healthcare delivery while continuing to serve the unique needs of America’s business elite.