The private aviation sector continues to evolve at an unprecedented pace, with high-net-worth individuals and corporations increasingly relying on business jets for efficient travel solutions. As we navigate through 2025, the landscape of private aviation insurance has become more sophisticated, reflecting the growing complexity of aircraft operations, regulatory requirements, and risk exposures that premium aircraft owners face.

Premium business jet requiring comprehensive insurance coverage

The United States remains the world’s largest market for private aviation, with over 14,000 business aircraft in operation across the country. This substantial fleet represents billions of dollars in assets that require comprehensive insurance protection. The premium segment of this market, encompassing aircraft valued at $10 million and above, demands specialized insurance solutions that go far beyond basic coverage requirements.

The Evolution of Private Aviation Insurance

Private aviation insurance has transformed significantly over the past decade, adapting to technological advances, changing risk profiles, and evolving regulatory landscapes. The industry has moved from standardized policies to highly customized coverage solutions that address the unique needs of premium aircraft owners.

Modern private aviation insurance encompasses multiple layers of protection, each designed to address specific aspects of aircraft ownership and operation. The complexity of contemporary aircraft systems, from advanced avionics to sophisticated maintenance requirements, has necessitated more nuanced approaches to risk assessment and coverage provision.

The COVID-19 pandemic fundamentally altered the private aviation landscape, accelerating demand while simultaneously creating new risk considerations. Insurance providers have responded by developing innovative coverage options that address pandemic-related operational disruptions, crew health concerns, and changing travel patterns.

Comprehensive Coverage Framework

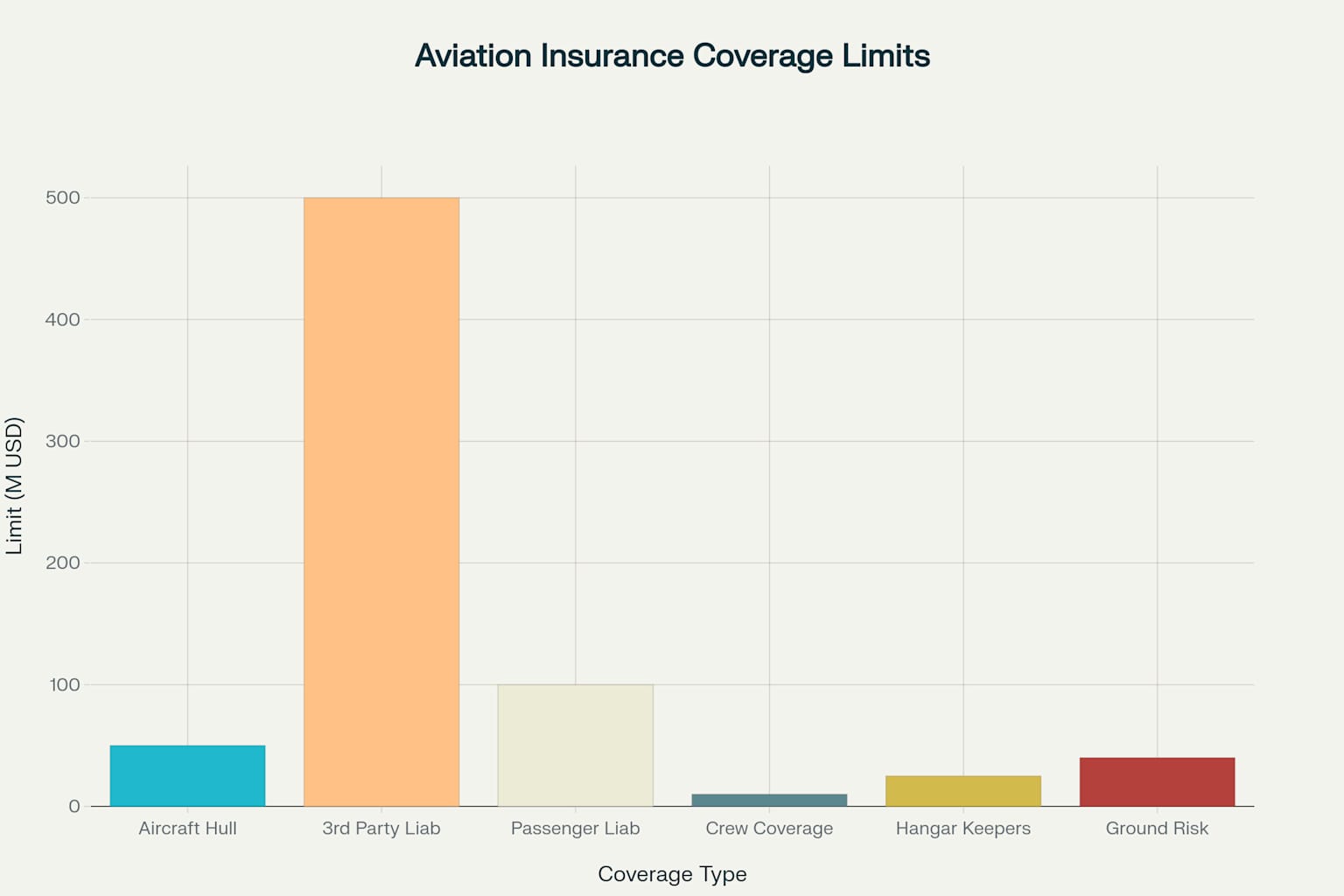

Understanding the complete spectrum of private aviation insurance requires examining each coverage component and its role in protecting premium aircraft owners. The modern insurance framework consists of six primary coverage types, each addressing distinct aspects of aviation risk.

Main types of private aviation insurance coverage and their typical coverage limits in 2025

Aircraft Hull Coverage

Aircraft hull coverage represents the foundation of any private aviation insurance program. This coverage protects the physical aircraft against a comprehensive range of perils, including collision, fire, theft, vandalism, and weather-related damage. For premium aircraft, hull coverage typically ranges from $20 million to over $100 million, depending on the aircraft’s value and specifications.

The valuation methodology for hull coverage has evolved to incorporate sophisticated assessment techniques. Modern approaches consider not only the aircraft’s current market value but also factors such as avionics upgrades, interior modifications, and maintenance history. Premium aircraft owners often opt for agreed value coverage, which establishes the insured value at policy inception and eliminates potential disputes during claim settlement.

Deductibles for hull coverage vary significantly based on aircraft type, usage patterns, and the owner’s risk tolerance. Typical deductibles range from $50,000 to $500,000 for premium aircraft, with some owners choosing higher deductibles to reduce premium costs while maintaining comprehensive protection.

Third-Party Liability Protection

Third-party liability coverage serves as perhaps the most critical component of private aviation insurance, protecting aircraft owners against claims arising from bodily injury or property damage to persons not aboard the aircraft. In today’s litigious environment, liability exposure can reach astronomical levels, making adequate coverage limits essential.

Premium aircraft owners typically maintain liability limits ranging from $100 million to $1 billion or more. The determination of appropriate limits considers factors such as aircraft size, typical passenger loads, operational areas, and the owner’s overall asset exposure. Many sophisticated owners structure their liability coverage through a combination of primary and excess layers, creating a comprehensive liability tower.

The legal landscape surrounding aviation liability continues to evolve, with courts increasingly willing to award substantial damages in aviation accident cases. This trend has driven many premium aircraft owners to increase their liability limits and explore innovative coverage structures that provide enhanced protection.

Passenger Liability Coverage

Passenger liability coverage addresses the aircraft owner’s responsibility to passengers aboard the aircraft. This coverage typically operates within the overall liability program but may include specific provisions for passenger-related claims. The coverage addresses both bodily injury and, in some cases, mental anguish or emotional distress claims.

Premium aircraft owners often face unique passenger liability exposures due to the high-profile nature of their passengers. Business leaders, celebrities, and other prominent individuals may generate increased public scrutiny and potentially higher damage awards in the event of an incident. Specialized passenger liability coverage addresses these enhanced exposures.

Modern passenger liability coverage often includes provisions for medical payments, emergency medical evacuation, and repatriation expenses. These benefits provide immediate financial support for injured passengers while preserving the owner’s relationship with passengers and their families.

Crew Coverage and Protection

Aviation crew members represent the most valuable component of any flight operation, and their protection requires specialized insurance consideration. Crew coverage has evolved significantly as the industry recognizes the unique risks and responsibilities associated with private aviation operations.

Professional liability coverage for pilots and crew members addresses claims arising from alleged errors, omissions, or negligent acts in the performance of their duties. This coverage has become increasingly important as regulatory scrutiny intensifies and the complexity of modern aircraft systems continues to grow.

Crew personal accident coverage provides financial protection for flight crew members in the event of injury or death during flight operations. Premium aircraft owners often provide enhanced crew benefits that exceed standard workers’ compensation requirements, recognizing the specialized nature of aviation operations and the difficulty of replacing experienced crew members.

The recruitment and retention of qualified crew members has become increasingly challenging, leading many premium aircraft owners to expand their crew-related insurance benefits. These enhanced programs often include coverage for ongoing training, recurrent education, and professional development activities.

Hangar and Ground Risk Protection

Ground operations represent a significant source of potential liability and property damage for private aircraft owners. Hangar keepers liability coverage protects against damage to the aircraft while in the care, custody, and control of third parties, including maintenance facilities, fixed-base operators, and storage providers.

The complexity of modern maintenance operations has increased the importance of comprehensive hangar keepers coverage. Today’s aircraft require sophisticated diagnostic equipment, specialized tools, and highly trained technicians. Any of these elements can potentially cause damage to the aircraft, creating substantial financial exposure for both the aircraft owner and the service provider.

Ground risk hull coverage addresses physical damage to the aircraft while on the ground, including damage that occurs during taxi operations, ground handling, and maintenance activities. This coverage fills gaps that may exist in standard hull coverage and provides specialized protection for ground-based risks.

Premium Trends and Market Dynamics

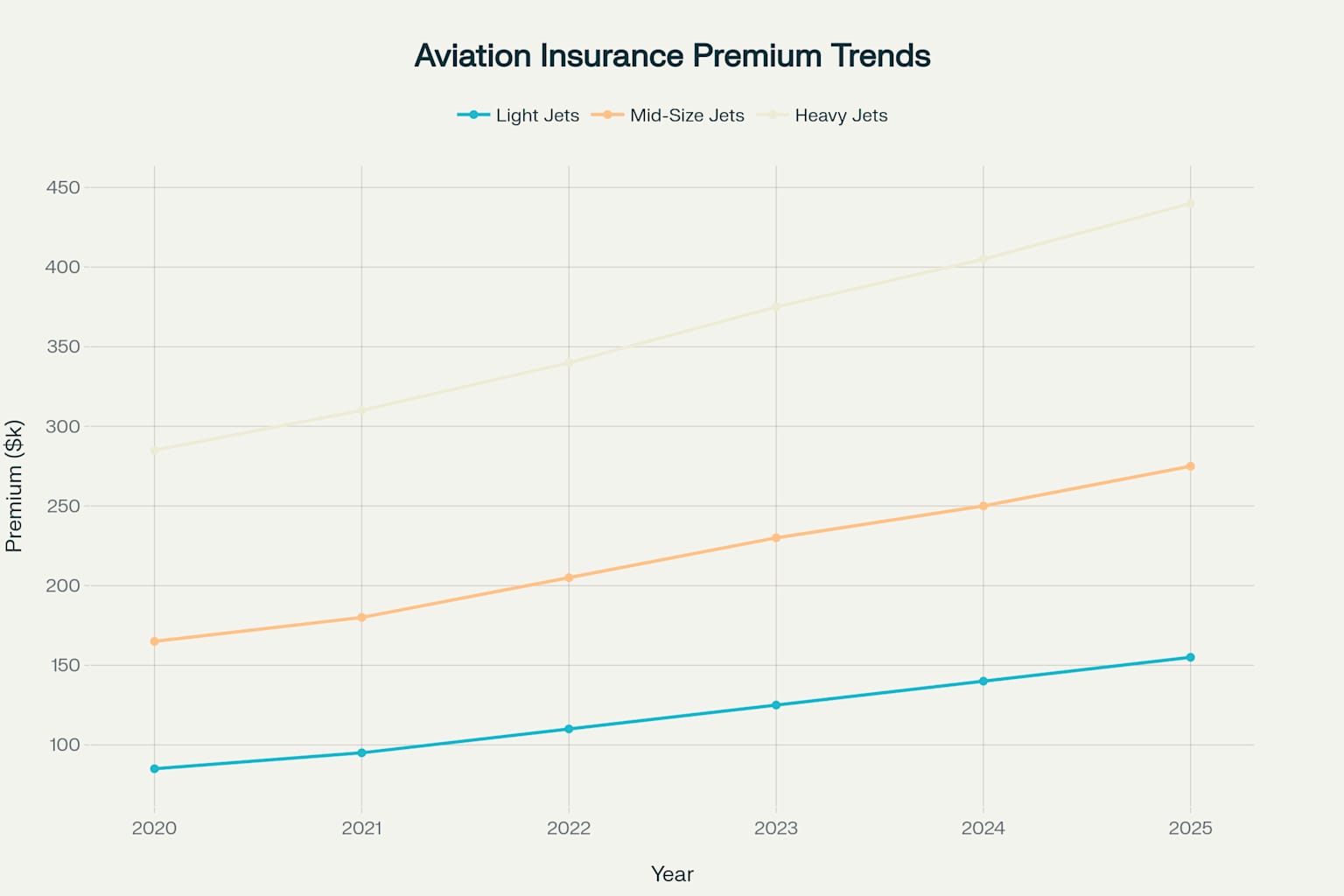

The private aviation insurance market has experienced significant volatility in recent years, with premium increases reflecting a combination of factors including increased claims activity, reduced insurer capacity, and evolving risk profiles.

Private aviation insurance premium trends showing increasing costs across all aircraft categories from 2020-2025

Market analysis reveals consistent upward pressure on insurance premiums across all aircraft categories. Light jets have experienced the most modest increases, with premiums rising approximately 15-20% annually over the past five years. Mid-size and heavy jets have faced more substantial increases, with some segments experiencing premium growth exceeding 25% annually.

Several factors contribute to these premium increases. The consolidation of insurance markets has reduced competition while simultaneously increasing the complexity of risk assessment. Insurers have become more selective in their underwriting approach, leading to tighter terms and conditions for many aircraft owners.

The frequency and severity of aviation claims have also influenced premium trends. While the overall safety record of private aviation continues to improve, individual claims have become more expensive due to increased aircraft values, higher liability awards, and more complex repair requirements.

Weather-related claims represent an increasingly significant component of aviation insurance losses. Climate change has contributed to more frequent and severe weather events, creating new challenges for aircraft operators and insurers alike. Many insurers have responded by implementing more restrictive coverage terms for weather-related perils.

Risk Assessment and Underwriting Evolution

Modern aviation insurance underwriting has evolved into a highly sophisticated process that considers multiple risk factors beyond traditional criteria. Insurers now utilize advanced analytics, artificial intelligence, and comprehensive databases to assess risk more accurately than ever before.

Pilot qualifications remain a cornerstone of aviation underwriting, but the assessment criteria have become more nuanced. Insurers evaluate not only total flight time and aircraft-specific experience but also factors such as recurrent training participation, simulator proficiency, and safety management system implementation.

Aircraft maintenance practices receive increased scrutiny during the underwriting process. Insurers favor operators who utilize manufacturer-authorized service centers, maintain comprehensive maintenance records, and implement proactive maintenance programs. The use of predictive maintenance technologies and condition monitoring systems often results in more favorable underwriting terms.

Operational factors play an increasingly important role in risk assessment. Insurers carefully evaluate factors such as typical flight routes, airport utilization patterns, weather exposure, and international operations. Advanced risk modeling tools allow insurers to quantify these exposures more precisely and adjust pricing accordingly.

Regulatory Compliance and Coverage Implications

The regulatory environment for private aviation continues to evolve, creating new insurance requirements and coverage considerations. The Federal Aviation Administration regularly updates regulations affecting private aircraft operations, and insurance coverage must adapt to address these changing requirements.

International operations create additional regulatory complexity, as aircraft owners must comply with varying insurance requirements across different jurisdictions. Many countries require specific minimum liability limits or mandate local insurance arrangements, necessitating careful coordination between primary and local insurance programs.

The implementation of new safety technologies often carries insurance implications. While these technologies generally improve safety and may result in premium reductions, they also create new coverage considerations. For example, the increasing use of synthetic vision systems, traffic collision avoidance systems, and automated flight controls requires specialized coverage for technology-related risks.

Cybersecurity has emerged as a critical consideration for modern aviation operations. Connected aircraft systems create potential vulnerabilities that require specialized insurance protection. Many insurers now offer cyber liability coverage specifically designed for aviation operations, addressing risks such as data breaches, system compromises, and operational disruptions.

Claims Management and Recovery Strategies

Effective claims management has become increasingly important as aviation insurance claims grow in complexity and cost. Premium aircraft owners benefit from proactive claims management strategies that minimize disruption and optimize recovery outcomes.

The initial response to an aviation incident significantly impacts the ultimate claim outcome. Immediate notification to insurers, preservation of evidence, and coordination with regulatory authorities are essential steps that can influence both the claims process and potential legal proceedings.

Modern claims management utilizes sophisticated investigation techniques, including advanced forensic analysis, computer modeling, and expert witness coordination. These tools help establish causation, quantify damages, and develop effective settlement strategies.

The repair and restoration of premium aircraft often involves complex coordination between insurers, manufacturers, and specialized repair facilities. The limited number of qualified repair facilities for high-end aircraft can create logistical challenges and extend repair timelines, making efficient claims management even more critical.

Specialized Coverage Considerations

Premium aircraft owners often require specialized coverage extensions that address unique exposures not covered by standard aviation policies. These specialized coverages reflect the sophisticated nature of high-end aviation operations and the substantial assets at risk.

War and terrorism coverage has gained increased importance in the current global security environment. While basic war coverage is often included in standard policies, premium aircraft owners frequently purchase enhanced war and terrorism coverage that provides broader protection and higher limits.

Kidnap and ransom coverage addresses the potential for crew or passenger kidnapping, particularly during international operations. This coverage provides both financial protection and access to specialized response services that can facilitate safe resolution of kidnapping incidents.

Business interruption coverage compensates for lost income when aircraft operations are disrupted due to covered perils. This coverage is particularly valuable for aircraft used in revenue-generating activities or when aircraft unavailability creates significant business disruption.

Technology Integration and Coverage Innovation

The integration of advanced technologies into private aviation operations has created new insurance opportunities and challenges. Insurers are developing innovative coverage solutions that address technology-related risks while incentivizing the adoption of safety-enhancing technologies.

Unmanned aircraft systems and autonomous flight technologies represent emerging areas of coverage development. While fully autonomous private aircraft operations remain in the future, the gradual integration of autonomous systems requires careful insurance consideration.

Artificial intelligence and machine learning applications in aviation operations create new risk profiles that insurers must address. These technologies offer significant safety benefits but also introduce new failure modes and liability exposures that require specialized coverage.

The increasing connectivity of aircraft systems creates cybersecurity vulnerabilities that require comprehensive insurance protection. Modern cyber coverage for aviation operations addresses both first-party costs and third-party liability arising from cyber incidents.

Strategic Insurance Program Design

Designing an optimal insurance program for premium aircraft owners requires careful consideration of multiple factors, including risk tolerance, asset protection objectives, and operational requirements. The most effective programs balance comprehensive coverage with cost efficiency.

Comprehensive insurance evaluation process for private aircraft owners

The structure of modern aviation insurance programs often incorporates multiple layers of coverage, each designed to address specific risk exposures. Primary coverage provides the foundation, while excess layers add capacity and specialized protection for catastrophic exposures.

Captive insurance arrangements have gained popularity among sophisticated aircraft owners, providing greater control over coverage terms, claims handling, and investment income. These arrangements require careful consideration of regulatory requirements and operational complexity but can offer significant advantages for qualified owners.

Self-insurance strategies may be appropriate for certain exposures, particularly when combined with traditional insurance for catastrophic risks. These strategies require careful analysis of potential exposures and adequate financial reserves to address retained risks.

Global Considerations for International Operations

International aviation operations create complex insurance requirements that must address varying regulatory environments, coverage requirements, and legal systems. Premium aircraft owners engaged in international operations require specialized insurance arrangements that provide seamless global protection.

Local insurance requirements vary significantly across jurisdictions, with some countries mandating specific coverage types or minimum limits. Careful coordination between primary insurance programs and local policies ensures compliance while avoiding coverage gaps or duplications.

Political risk coverage addresses unique exposures associated with international operations, including confiscation, currency inconvertibility, and political violence. These coverages are particularly important for operations in emerging markets or politically unstable regions.

Repatriation coverage ensures that aircraft and passengers can be safely returned to their home base in the event of international incidents. This coverage often includes coordination with government agencies and specialized service providers.

Future Outlook and Emerging Trends

The private aviation insurance market continues to evolve rapidly, driven by technological advancement, changing risk profiles, and market dynamics. Several trends are likely to shape the future of aviation insurance for premium aircraft owners.

Predictive analytics and artificial intelligence are revolutionizing risk assessment and pricing methodologies. These technologies enable insurers to identify risk patterns more accurately and develop more precise pricing models, potentially leading to more individualized coverage and pricing.

Environmental considerations are gaining increased importance, with insurers beginning to factor climate change impacts into their risk assessment processes. Carbon offset requirements and environmental liability exposures may become standard considerations in aviation insurance programs.

The continued growth of private aviation, particularly in emerging markets, is creating new opportunities and challenges for insurers. These markets often lack established regulatory frameworks and infrastructure, requiring innovative insurance solutions.

The development of new aircraft technologies, including electric and hybrid propulsion systems, will create new insurance considerations. These technologies offer environmental benefits but also introduce new risk profiles that insurers must evaluate and price appropriately.

Best Practices for Premium Aircraft Owners

Successful aviation insurance management requires ongoing attention to multiple factors, from initial program design through claims resolution. Premium aircraft owners benefit from implementing comprehensive risk management strategies that complement their insurance programs.

Regular insurance program reviews ensure that coverage remains appropriate as operations evolve and risk exposures change. These reviews should consider factors such as aircraft utilization patterns, crew qualifications, maintenance practices, and regulatory developments.

Proactive risk management demonstrates commitment to safety and often results in more favorable insurance terms. Effective risk management programs include comprehensive safety management systems, regular training programs, and ongoing monitoring of operational performance.

Strong relationships with insurance partners facilitate better coverage terms and more effective claims resolution. Premium aircraft owners benefit from working with insurers and brokers who understand the unique requirements of high-end aviation operations.

Documentation and record-keeping practices significantly impact both underwriting and claims outcomes. Comprehensive maintenance records, pilot training documentation, and operational logs support favorable insurance terms and expedited claims processing.

The private aviation insurance landscape in 2025 presents both opportunities and challenges for premium aircraft owners. Success requires understanding the complex coverage options available, staying current with market trends, and implementing comprehensive risk management strategies. As the industry continues to evolve, those who proactively address their insurance needs will be best positioned to protect their valuable aviation assets while maintaining operational flexibility.

The investment in comprehensive insurance protection represents a critical component of responsible aircraft ownership. With proper planning and execution, premium aircraft owners can achieve the optimal balance of coverage, cost, and operational efficiency that supports their aviation objectives while protecting their substantial investments.